In this article, we look at some of the top USB ASIC miner devices on the market as well as explain the advantages and disadvantages of using a USB ASIC miner versus traditional mining hardware. Finally, we try to assess whether or not the profits justify the costs of buying one of these devices.

Why Use a USB ASIC Miner Over Mining Hardware?

Before getting started, it’s important to ask yourself, “Why should I buy a USB ASIC miner?” Depending on your purpose, the disadvantages can vastly outweigh the advantages.

Advantages of USB ASIC Miners

Lower Costs

Even an average-quality ASIC mining rig can cost a few hundred dollars. A high-quality ASIC rig could cost over $3,000. In comparison, a USB ASIC miner costs less than $50 in most cases. There are some units like the 21 Bitcoin Computer that cost $150, which can technically be classified as a USB miner, but these are on the high end.

There are also a few other investment factors to consider. For example, projects are changing consensus algorithms to become more ASIC-resistant. This means that expensive ASIC mining rigs could become obsolete out of the blue. Because they can’t be reconfigured for other purposes, this could mean a significant loss. Yes, this would affect USB ASIC rigs as well. However, the loss of investment would be significantly less in comparison.

Easier Setup Process

One of the most difficult aspects of starting a successful mining operation is the setup process. For the most part, mining rigs aren’t plug-and-play. It takes a while to configure one and start mining cryptocurrencies. In contrast, the process of setting up with a USB ASIC miner is pretty simple, and several tutorials are available.

Greater Mobility

If you’re an experienced miner or even someone who is new to mining, you probably know about how expansive mining operations can be. In many cases, even small operations can take up a lot of space.

For people who either travel often or don’t have enough room to setup hardware mining rigs, it can be difficult to maintain a traditional mining operation. With a USB ASIC miner, however, you should have the ability to utilize both desktops and laptops. This allows you to mine from practically wherever you can connect to the internet.

Disadvantages of USB ASIC Miners

Lower Hash Rates

When it comes to cryptocurrency mining, hash rate is quite possibly the most important factor. A lower hash rate drastically reduces your chances of finding the next block and receiving the mining reward. Competing against other miners who use a traditional mining rig (or several) with a simple USB ASIC miner isn’t a realistic goal.

Lower Profits

You should expect lower profits with a USB ASIC miner. However, it’s essential to look at this from an ROI standpoint. A smaller investment means that you won’t go into a large deficit. Is it possible to make a net profit from a USB ASIC miner? We’ll explain more in the costs versus profitability section below.

Top USB ASIC Miner Devices

There are numerous ASIC, GPU and CPU options on the market today. Unfortunately, there aren’t as many companies offering USB ASIC miner devices.

Why is this the case? Let’s find out by taking a look at the technical details and customer reviews of three of the most popular units available in 2018. Note that shipping costs are not included in the following costs and that prices can fluctuate.

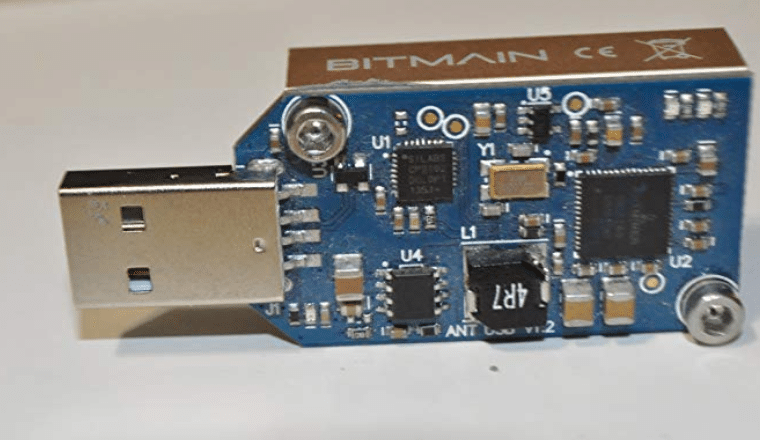

Bitmain Antminer U2

Cost: $49.97 (used)

Bitmain is the biggest player in the crypto mining market. The company produces all sorts of mining rigs intended for a variety of PoW consensus algorithms. The Antminer U2 is another great example of its diverse product lineup. As of October 3, 2018, the Antminer U2 only had two reviews on Amazon.

One review is quite positive (5 stars). The reviewer highlights the fact that users can learn about mining, cloud mining, and more via this USB ASIC device. However, the other review is negative (1 star) and complained about the device not being recognized on three different computers.

According to one customer question that was answered in November 2017, this device doesn’t work anymore due to the fact that the BTC difficulty has increased. It’s important to note that the Antminer U2 only mines BTC and, like many other USB ASIC units, can’t mine other cryptocurrencies.

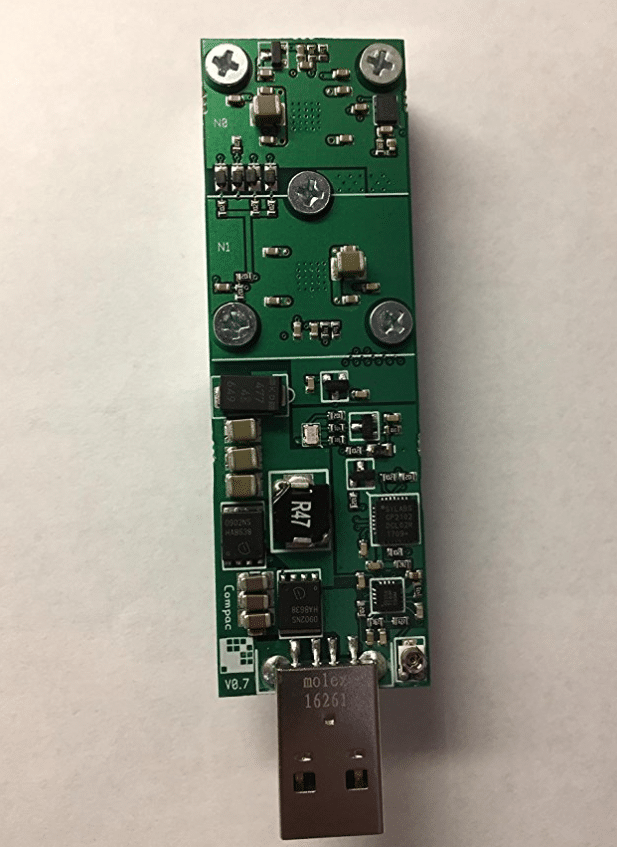

GekkoScience 2Pac

Cost: $44.95

The product description claims that the GekkoScience 2-Pac is the most efficient USB miner ever made. Don’t let the name confuse you, though. This is only one device and not two devices in a pack. This USB ASIC miner includes two Bitmain BM1384 chips (same as the chip in the Bitmain Antminer S5) and a fully-adjustable regulator design, which gives you a core voltage range of 550mV to 800mV. The typical hash rate is 15+GH/s, depending on clock rate. Efficiency is .31-.35 watts per GH.

GekkoScience also recommends that people use the CGMiner along with this device. It appears that most reviews are realistic about what this particular USB ASIC miner can achieve. For example, most don’t have high aspirations for an immediate ROI.

NanoFury 2

Cost: $89

The NanoFury 2 miner comes with two Bitfury ASIC Chips. Speed per bits is 50 bits – 3.7-4.1 GH/s and 53-55 bits – 4.7-5.4 GH/s. It also includes a heat sink on the back to better disperse heat. This means that you should expect a better lifespan for this particular USB ASIC miner.

For those concerned with the possibility of a difficult setup, this device requires no additional drivers. It also comes with Bfgminer & Cgminer support. One would expect that this device to perform better over time versus cheaper USB ASIC miner units. In addition, it’s possible to mine a variety of SHA256 coins besides BTC, some of which include DigiByte and Joulecoin.

The Nano Fury 2 is easy to install. No drivers are required, and it includes Bfgminer & Cgminer support.

Costs vs. Profitability

Unfortunately, the customers say that it’s difficult/impossible to achieve a good ROI with these units. Most say that the results aren’t worth the investment.

For example, one Rev 2 GekkoScience 2-Pac user recommends using a seven-port USB hub that can support USB sticks. This user also recommends that users choose cgminer and point to a P2Pool node. In total, the user estimates that you would have to spend $600 to $800, which would give you a break even timeline of 20 months. However, each time that the BTC block payout halves, it will take longer to achieve breakeven. It’s also important to understand that this advice was posted in January 2018 when cryptocurrency prices were at or around their highest point in history. With a bear market, gaining profits can become even more challenging.

You should also consider the amount of time and resources needed to mine daily and maintain your mining operations. At the end of the day, is USB ASIC mining worth it? If you’re looking solely at profitability, it’s far better to choose traditional hardware mining. However, if you’re looking at reducing upfront costs and don’t want to go through the process of setting up a full-scale operation, trying out USB mining might be a better choice.