DigiByte is a cryptocurrency that focuses on security, decentralization, and speed. Founded in 2014, it’s part of the older class of cryptocurrency projects. However, despite its age and ongoing development over the past four years, this project is still relatively unknown.

In this guide we cover:

What Is DigiByte?

DigiByte’s supporters argue that it’s the sleeping giant of cryptocurrency. According to its fans, it’s on the cutting edge of crypto-technology. It hosts a network that’s faster, more scalable, and more secure than other major currencies. Over time, they argue, its superior technology will win out against Bitcoin, Litecoin, and other top digital cash options. The project has a dedicated community and nearly 100,000 nodes across the globe.

DigiByte Features

On the other hand, adoption over the past four years has been slow. It’s still a relatively obscure currency compared to its competitors. The DigiByte website offers a lot of great marketing copy and buzzwords. However, there’s little technical information about how the network actually functions. It’s difficult to get a sense of the real achievements of DigiByte versus things they have planned for the future.

In this article, we’ll try to dig deeper into the platform – its history, technological specifications, and its achievements. In the end, you’ll have to make your own decisions about whether DigiByte is the next big thing or mostly fluff.

History & Team

Jared Tate developed DigiByte in 2013 and launched the genesis block in January 2014. At the time, it was one of only a handful of public blockchain projects. It launched without an initial token sale and with little fanfare.

DigiByte Creator Jared Tate

After the launch, Tate dedicated himself full time to DigiByte’s development. Since then, funding for the project has come through donations to the DigiByte foundation. It’s also reasonable to assume that Tate and others involved in the project hold a significant amount of DGB (the native coin) from mining and initial transactions. Their wealth would increase any time the price of DGB increases.

Speaking of other people working on the team, it’s difficult to find much out about the staff supporting the project. The website doesn’t contain information about the team. A little digging on LinkedIn turned up a total of fewer than ten developers who claim to work for the project, including Tate.

Trading History

As with all cryptocurrency, DigiByte’s price has been volatile recently. Up until 2017, it’s price remained relatively constant, with only slight growth. However, 2017 and 2018 saw a series of spikes and crashes for DGB.

A June 2017 spike came when DigiByte hinted at an impending announcement on Twitter. Investors looking to make money off the announcement quickly bought into DigiByte. This pumped the price. However, the announcement didn’t come for several more days. It introduced a new wallet and a few added features. By the time of the announcement, the price of DGB had already collapsed to near pre-announcement levels.

DigiByte’s price spiked again in December 2017-January 2018. John McAfee, a popular crypto-investor, tweeted about DigiByte as a company worth watching. The resulting December spike carried into the new year. But, it eventually collapsed along with the rest of the crypto market in the correction of January 2018.

There have been no major fluctuations in 2018, except for a brief period in Q3 of this year where the price rose for a month or two. This came around the same time the company announced wallet availability for iOS and Android, which may explain it. Also at this time, the Apple App Store started allowing payments in Digibyte.

Technical Specs

Like Bitcoin, DigiByte is a UTXO-based cryptocurrency. This means that new transactions don’t come from a wallet “balance.” Instead, each individual coin has an identifier. When a coin enters your wallet, it is considered “unspent” by your wallet. When you send that coin to someone else, it becomes a spent coin. This prevents the double spend problem of digital currency. It also solves other security issues with the blockchain.

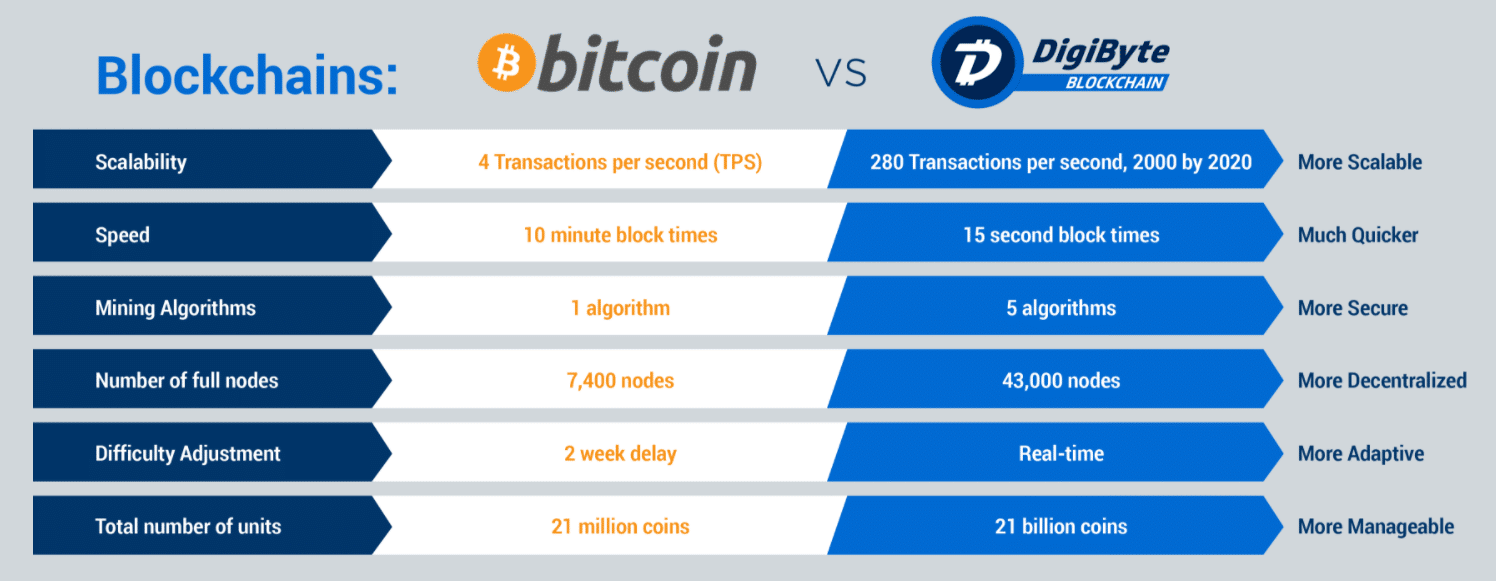

DigiByte vs. Bitcoin

Blocks, Mining, and Hashing Algorithms

DigiByte launched its genesis block on January 10th, 2014. At launch, it used a single proof of work algorithm. Soon after, however, it conducted a hard fork to introduce a total of five proof of work algorithms including SHA256 (the Bitcoin algorithm) and Scrypt (used by Litecoin and Dogecoin). Splitting the mining between algorithms encourages decentralization and increases the security of the network.

A new block is mined approximately every 15-18 seconds. Each of the five mining algorithms mines one block every 1.5 minutes. Within each block, transaction sizes are limited. DigiByte was also the first to implement Segregated Witness technology, helping keep its blockchain small and scalable. The fast blocktime combined with four years of existence means this project has the longest blockchain currently in existence. Longer even than Bitcoin’s.

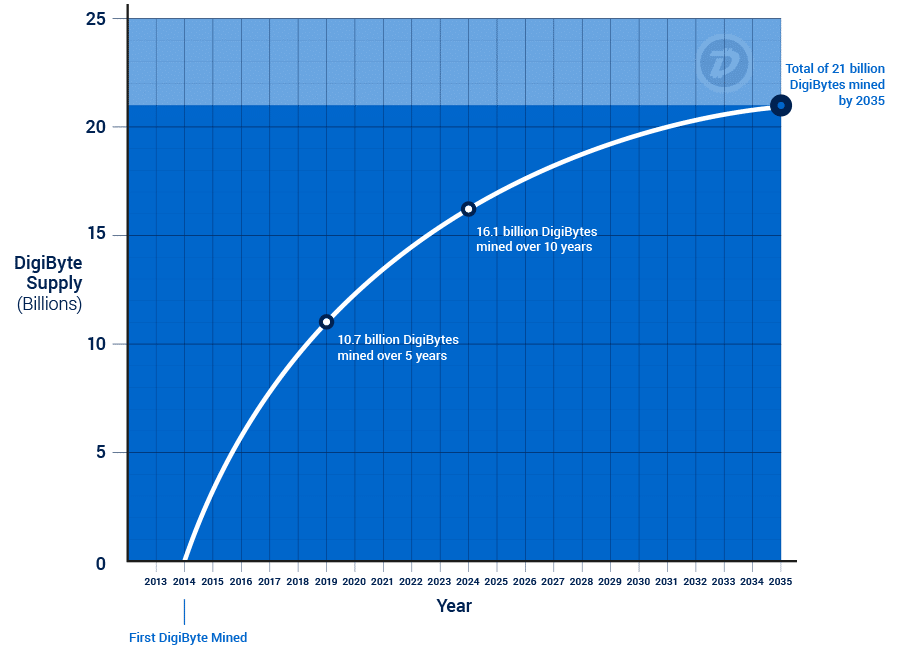

Coin Supply

DigiByte Coin Supply

Ultimately, the DigiByte blockchain will mine 21 billion DGB over the course of 21 years. There are currently over 11 billion DGB in circulation.

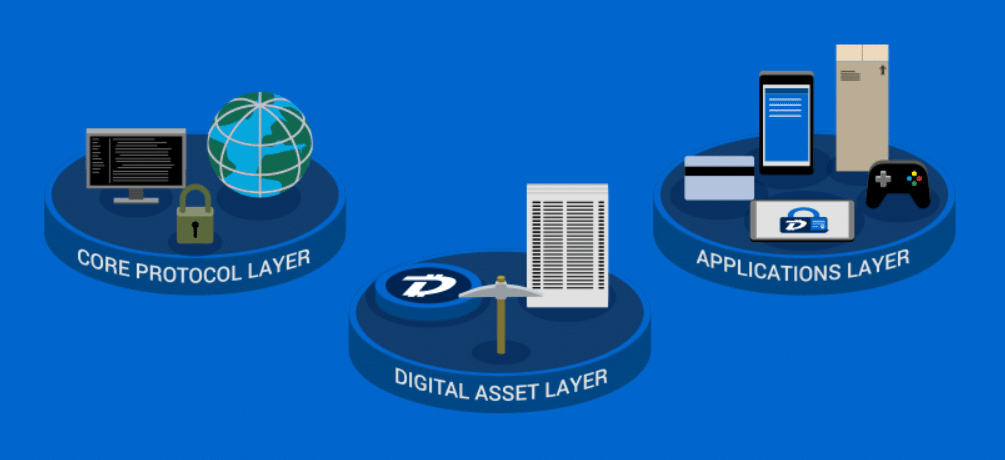

Layered Infrastructure

DigiByte Infrastructure Layers

The software infrastructure consists of three layers that function on top of one another:

- Core Communications & Global Network – This connects all the nodes on the network together. It supports very basic data transfer between nodes and establishes the foundation for other layers.

- Public Ledger & Digital Assets – This is where the network’s data gets stored. It also has security measures in place to prevent manipulation of data. It incentivizes and manages miners securing the platform.

- Applications – This is the user-facing part of the blockchain. It involves the interface, transfers, API, and any other everyday applications built on the DigiByte network.

Faster Block Time & Higher Throughput

DigiByte’s faster block time means transactions get processed and confirmed much faster on its network. DigiByte’s block time is 15 seconds, placing it around 40x faster than Bitcoin. Of course, faster block times come with scalability issues as each node on the network must maintain the entire history of the blockchain in order to confirm new transactions. DigiByte’s blockchain is already the longest in the world.

To counter these challenges, DigiByte was the first cryptocurrency to implement segregated witness (SegWit). SegWit separates transaction confirmations from the transaction information in the block. This makes the ledger more compact. In addition, SegWit allows for innovations like cross-chain transactions and single confirmation transactions. These options are potential avenues for development on DigiByte’s blockchain.

DigiByte also limits transaction size and scope. There’s little documentation explaining how this works exactly, but the team claims such limitations on transactions make their blockchain more efficient. In addition, limiting transaction scope theoretically protects the security of the network.

Fast block times and small transaction size allow a throughput of around 280 transactions per second. That’s fast compared with Bitcoin’s current eight transactions per second. However, it pales in comparison to payment processors like Visa, who can handle 2,000 transactions per second. DigiByte plans to reach the 2,000 transactions per second mark set by Visa and possibly surpass it. So far, however, those plans are still vague, without a clear roadmap.

More Secure

DigiByte also claims to be more secure than other currencies. Putting security first means making sure the entire platform is as decentralized as possible. This is part of the reason why the projects team hasn’t grown significantly. They’ve left much of the promotion and development up to the community, in a true decentralized fashion. The problem, of course, is one of coordination. While many people have contributed to the code base and proselytized the platform, it has largely been ad hoc, without much clear direction from the DigiByte Foundation.

DigiByte has, however, been successful at decentralizing its mining. They’ve done so largely through good mining incentives and use of five algorithms. These mining algorithms split miners and mining power into five equal, smaller groups. This keeps mining competitive while still allowing for each group to mine a block every 1.5 minutes. The blockchain has over 100,000 nodes across six continents.

DigiByte rebalances the load between the five mining algorithms by adjusting the difficulty of each so one algorithm doesn’t become dominant. This rebalancing technology is called MultiShield, and it’s one of DigiByte’s technical advancements. MultiShield’s early prototype, DigiShield, implemented responsive difficulty adjustment to prevent miners with lots of processing power from manipulating smaller blockchains. DigiShield’s asymmetric difficulty has gained notoriety and been deployed in many other blockchains.

Development Ahead of the Curve

DigiByte has established a reputation for being on the cutting edge of crypto-development. Its DigiShield technology gained wide acceptance as a solution for difficulty adjustment. It was also the first blockchain to implement SegWit. MultiAlgo mining has yet to catch on. However, that’s another area this project has pioneered in the blockchain industry.

Since DigiByte has the longest blockchain in existence, they’ve also faced scalability issues that other chains have yet to encounter. DigiByte’s blockchain is over 5 million blocks long. However, being on the cutting edge of development also leaves room for error. Until user adoption grows to the levels of the top cryptocurrencies, it’s difficult to say if DigiByte’s technology is robust as it claims.

In the future, DigiByte has plans to support smart contracts development on top of its blockchain. The developer community needs reliable, open-source tools to implement DigiByte apps and services. DigiByte.JS provides a reliable API for JavaScript apps that need to interface with the platform.

DigiByte’s website also claims the platform will support AI and IoT applications built on its blockchain.

As at the end of 2018, many of these updates remain in the pipeline for future developments. Developments in 2018 have largely been focused on increasing adoption through more exchange listings, additional wallets, and merchants who will accept DGB coins.

Future of Digibyte

Traction is the name of the game for DigiByte. So far in its four-year history, it hasn’t gotten much. 100,000 nodes is a respectable network size for an alternative currency. However, it is a relatively old currency, and it has had opportunities to gain massive support with the right messaging and public relations.

DigiByte is currently gaining traction in the gaming community. An offshoot, called DigiByte Gaming, offers DGB to gamers in exchange for time spent playing certain games.

Tate, the CEO, has promised to focus on public outreach and the DigiByte Foundation. At this point, gaining greater adoption is the largest challenge facing the project. DigiByte’s fate hangs in the balance. It could take off as a leader in speed, scalability, and security; or it could languish in continued relative obscurity.

As at the end of 2018, Digibyte continues to attract a loyal following.

Where to Buy DGB

You can purchase DGB on many major exchanges including Bittrex, Huobi or Poloniex – but not Binance though.

If you’re looking to mine it, then the various algorithms support ASIC and GPU mining.

Where to Store DGB

You can download DGB hot storage wallets for any operating system from the Digibyte website under the Wallets menu. You can also store your DGB coins in one of the usual offline storage wallets like Trezor or the Ledger Nano S.

Competition

As a UTXO cryptocurrency, DGB is competing with many other cryptos, including the almighty Bitcoin as well as Litecoin. Given that DigitByte has some of the fastest and cheapest crypto payments around, Dash is also a competitor. Another project on a comparable ranking but also using UTXO is Dogecoin.

Conclusion

With a supportive community, enhanced decentralization and use cases beyond pure payments, DigiByte has a lot going for it. With the prolonged 2018 bear market and few major developments, it is still struggling to gain true mainstream adoption. However, the bear market may be a good thing – it will clear out those tokens without a strong use case and make way for the projects with true potential. If DigiByte continues to focus efforts on increasing adoption whilst working on its big-ticket developments like smart contracts, the future could be bright for this altcoin.

Editor’s Note: This article was updated by Sarah Rothrie on November 30, 2018, to reflect the recent changes of the project.

Additional DigiByte Resources

Related

Maybe you already know you can do it in our channel. Telegram to share operations with other users:

Subscribe to the channel to find out all the latest news!

https://t.me/Guadagnare_sul_Forex

Subscribe to the Telegram group!

https://t.me/Guadagnaresul_Forex

It is important, in the group to interact with all investors to earn on Forex and know the investment strategies.

See you soon and good trading!

Earn on Forex

![Cinque nuovi Altcoin tra cui Monero [XMR], NEM [XEM], NEO [NEO], Lisk [LSK] e Verge [XVG] saranno disponibili sull’app Abra – Altcoin News Cinque nuovi Altcoin tra cui Monero [XMR], NEM [XEM], NEO [NEO], Lisk [LSK] e Verge [XVG] saranno disponibili sull’app Abra – Altcoin News](https://guadagnaresulforex.com/wp-content/uploads/2018/05/abra-bitcoin-678x381-300x182.jpg)