Exiting Losing Trades

Losing trades, to a professional trader, are nothing more than the cost of doing business. Market pros exit their losing trades without emotion, completely focused on following their trading system, money management, and risk control rules.

And as important as having winning trades is, exiting losing trades at the exact time your system advises is perhaps even more important. Losing trades tend to go from bad to worse in a hurry, and it’s your swift, passionless ability to cut such negative performers that will prevent serious damage to your trading account equity.

Here’s a look at three powerful strategies for exiting your losing trades. Generally, these style of trade exits will help keep losses small and stress levels low, preserving your trading capital for the next prime trade opportunity.

Strategy #1: Exiting After a Close Beyond a Significant Trendline

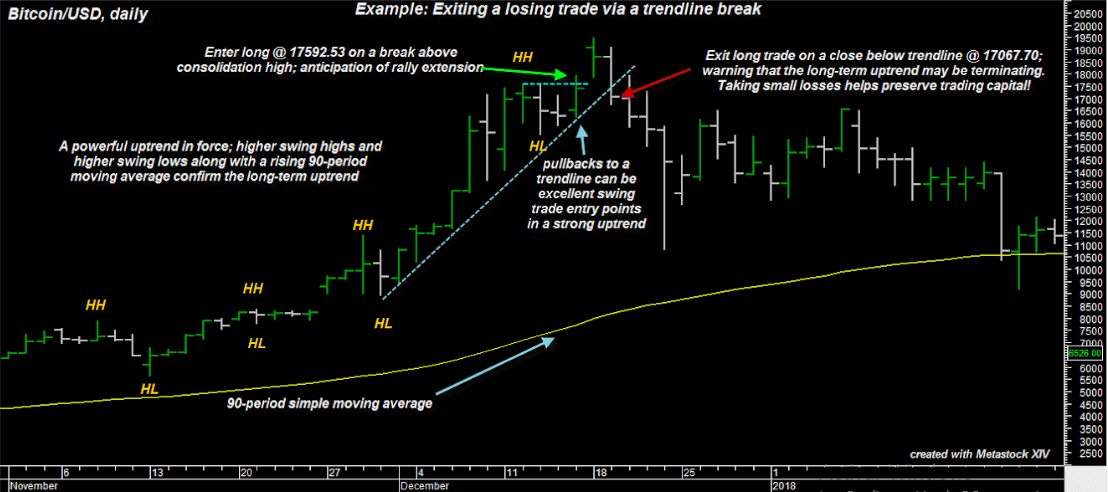

The incredible October-December 2017 rally in Bitcoin offered several low-risk long breakout and pullback entry points for chart-savvy traders. The chart below depicts the final chance to get long before the ultimate ‘blow off’ top on December 18, 2018:

Figure 1. Bitcoin/USD, daily: Pullbacks to an established trendline can often act as a low-risk entry point. Here, however, a long entry after such a pullback is stopped out for a small loss as it closes back below the trendline.

Note the backdrop for the buy setup:

- There was an extended series of higher swing lows and higher swing highs (HH, HL), which is the definition of an uptrend

- The 90-period simple moving average (SMA) was sloping higher – a major uptrend in force

- Price pulled back and touched the dashed uptrend line (light blue arrow) and then quickly reversed higher, breaking above the previous consolidation high

- Bitcoin surged nearly $2,000 higher the day after the breakout trade entry, only to fizzle, fade, and close back below the uptrend line on December 19, 2018

Anyone who took this breakout buy signal needed to be aggressive with profit-taking in order to walk away a winner. But, by simply exiting the trade once price closed back below the trendline, the loss would’ve been small.

Always remember that a close beyond a long-standing trendline is one of the most powerful trend reversal signals that you will encounter. The market is telling you in strong terms that your trade setup has failed and that you need to exit with a loss, ASAP.

Key Takeaways

- Established trendlines, especially those with a 45-degree angle of attack or higher, often act as powerful support ( or resistance) points

- When price reverses and closes beyond such an established trendline, odds are that the previous trend has terminated and begun to reverse

- If your long (or short) trade entry fails, closing on the other side of such a trendline, exit your trade immediately or risk even greater losses

Strategy #2: Exiting Once You Breach the Initial Stop Loss

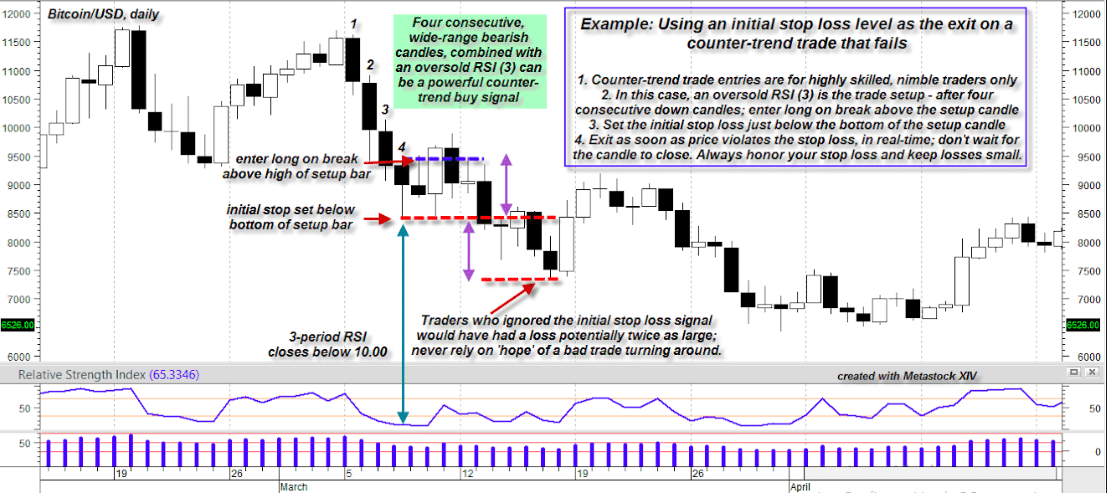

Counter-trend trading is a popular strategy for those looking to ‘scalp’ quick profits in a cryptocurrency that may have gotten a little ahead of itself. Generally, the gains on winning trades are about the same (or slightly less) than those of losing trades, so this style of trading needs a 70% or higher win percentage to be viable.

In the trade example below, BTCUSD has declined for four consecutive sessions with a large spread between the high and low of each bar. These attributes indicate substantial selling pressure. However, some counter-trend traders view this as an ideal buy set up, particularly when the 3-period Relative Strength Index, RSI (3), indicator closes below 10.00 on bar 4 of the decline. Here, the bar that caused the RSI to close below 10.00 is the setup bar, and any rise above its high is considered the long entry trigger.

No Traction = Time For Action

The trade doesn’t gain much traction and instead reverses lower for a modest loss. Note that we exit the trade as soon as the stop loss level (set just below the setup bar’s low) is breached, and not when the stop out bar makes its final close. It’s critical that counter-trend traders exit losing trades in real time rather than wait for the passive exit of a bar’s close. This method protects you in case price continues to head in the wrong direction, causing a much larger loss.

You should never rely on the hope that a losing trade will suddenly turn around and become profitable again. Instead, take your losses as soon as your trading rules dictate you to do so. In doing so, you preserve your trading account equity – and sanity.

Figure 2. Bitcoin/USD, daily: You need to be especially nimble when booking a loss on a non-performing trade entry. Here, BTCUSD rallies briefly before reversing and hitting its initial stop loss.

Key Takeaways

- Counter-trend trading is a fine strategy, but you must keep losses small

- Always keep your initial stop loss just beyond the extreme of the trade setup bar

- You should take counter-trend trade losses when the stop loss is triggered in real-time, not when the stop out bar finally closes out

- Honor the real-time stop loss point, or risk having a modest loss turn into a more substantial one

Strategy #3: Exiting After X-Number of Price Bars

Sooner or later, you’re going to find yourself with a position on your favorite coin in which it’s not cooperating at all. It literally goes sideways, trading in a small range after the initial entry, and offers you no clue as to its ultimate directional intentions. What should you do in such a situation, where neither the trade’s profit target nor initial stop loss has been hit?

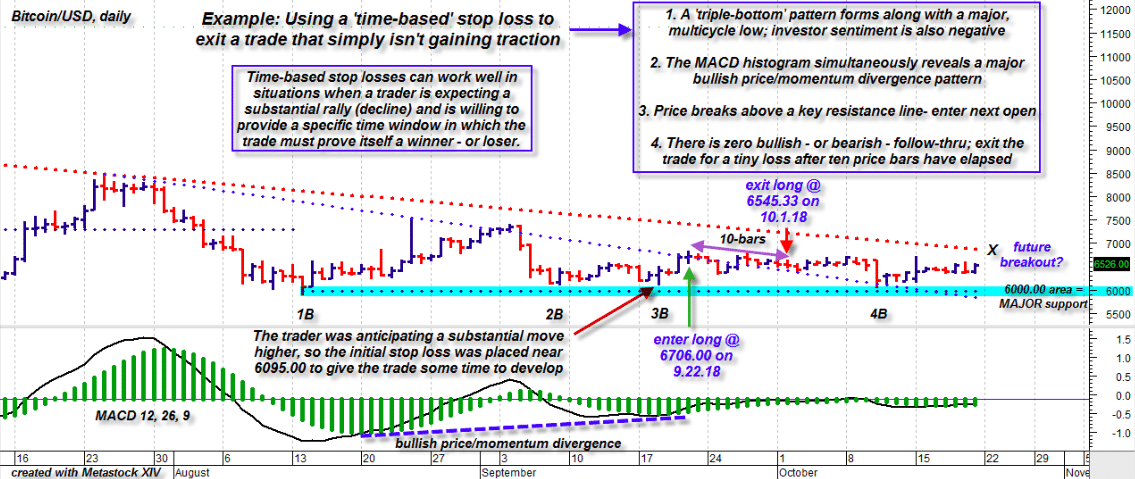

Using a time stop is one solution to the above dilemma. By analyzing historical price action in the coin, you can get an idea of how long it typically takes to exit a sideways market phase with a breakout. For example, if low-volatility consolidations are typically resolved in twelve bars or less, you may elect to exit a dead trade at the close of the thirteenth bar after the initial trade entry. Doing so frees up your trading capital for deployment into a more attractive trade setup elsewhere.

Figure 3. Bitcoin/USD: Time-stops can be a great solution for traders needing a rational way to exit a ‘do-nothing’ trade, freeing up trading capital for deployment elsewhere.

In the example above, BTCUSD formed a triple-bottom pattern (1B, 2B, 3B), printed a bullish MACD price/momentum divergence, and then quickly staged a breakout above a key trendline. These attributes paint a picture-perfect long trade entry. Then, the stock went lifeless. It didn’t hit its profit target (the upper trendline) nor its initial stop loss point. Volatility continued to wither, and with daily trading ranges collapsing at the completion of bar ten (since trade entry), the ideal move would have been to exit with a time stop.

Exiting this way would’ve saved you from a further decline to point 4B. Even better, your capital would have been free for deployment into other more promising trade setups. As this is written, BTCUSD continues to trade in a lifeless, ultra-low volatility, seven-week long trading range, and may only now be starting to show signs of life again.

Key Takeaways

- Even a picture-perfect trade setup can perform in frustrating ways

- When a trade has failed to reach either its profit target or initial stop loss after a significant period of time, close the trade

Summary

Knowing how and when to exit a losing trade is a key factor that separates the consistently winning crypto traders from the perennial losers. Your long-term success as a crypto trader will largely be determined by how well you master the art of keeping your losing trades small, regardless of your winning percentage. The three simple strategies presented in this article can help you achieve that important goal.

Disclaimer: The material presented in this article is to be construed as educational in nature only and in no way does it constitute specific investing and/or trading advice for any specific individual or entity. Speculation in the financial markets involves substantial risk and therefore only risk capital should be used when trading or investing. Always consult your licensed financial advisor before deploying risk capital in the financial markets.

Related

Maybe you already know you can do it in our channel. Telegram to share operations with other users:

Subscribe to the channel to find out all the latest news!

https://t.me/Guadagnare_sul_Forex

Subscribe to the Telegram group!

https://t.me/Guadagnaresul_Forex

It is important, in the group to interact with all investors to earn on Forex and know the investment strategies.

See you soon and good trading!

Earn on Forex

![Cinque nuovi Altcoin tra cui Monero [XMR], NEM [XEM], NEO [NEO], Lisk [LSK] e Verge [XVG] saranno disponibili sull’app Abra – Altcoin News Cinque nuovi Altcoin tra cui Monero [XMR], NEM [XEM], NEO [NEO], Lisk [LSK] e Verge [XVG] saranno disponibili sull’app Abra – Altcoin News](https://guadagnaresulforex.com/wp-content/uploads/2018/05/abra-bitcoin-678x381-300x182.jpg)